BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2015

56

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

45

24. Financial Risk Management…(continued)

Credit risk…(continued)

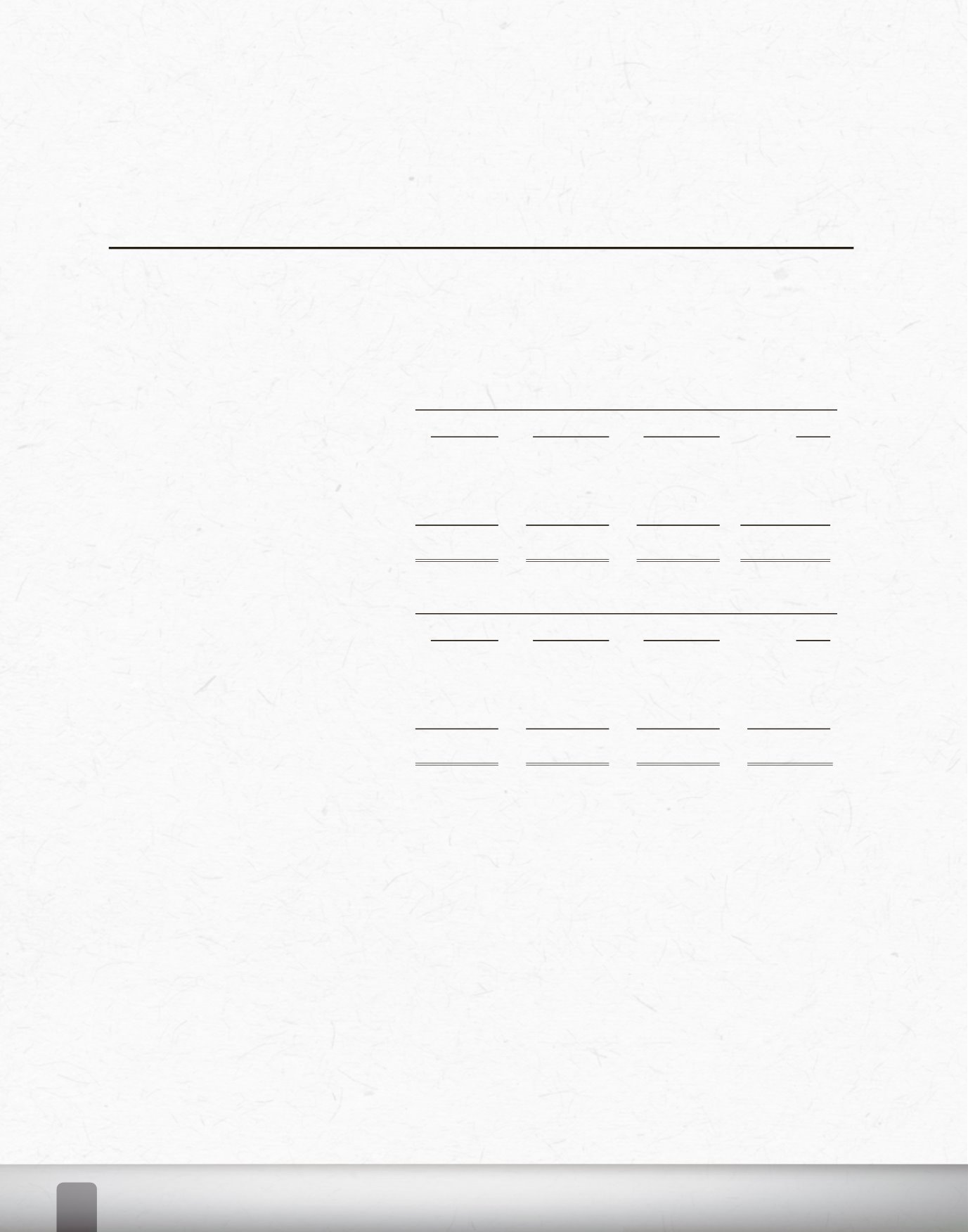

Aging analysis of past due but not impaired loans and advances:

2015

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 51,461,060

15,853,922

3,435,488

70,750,470

Mortgages

24,330,240

4,981,505

2,603,543

31,915,288

Business

991,501

182,012

28,034 1,201,547

Total

$ 76,782,801

21,017,439

6,067,065 103,867,305

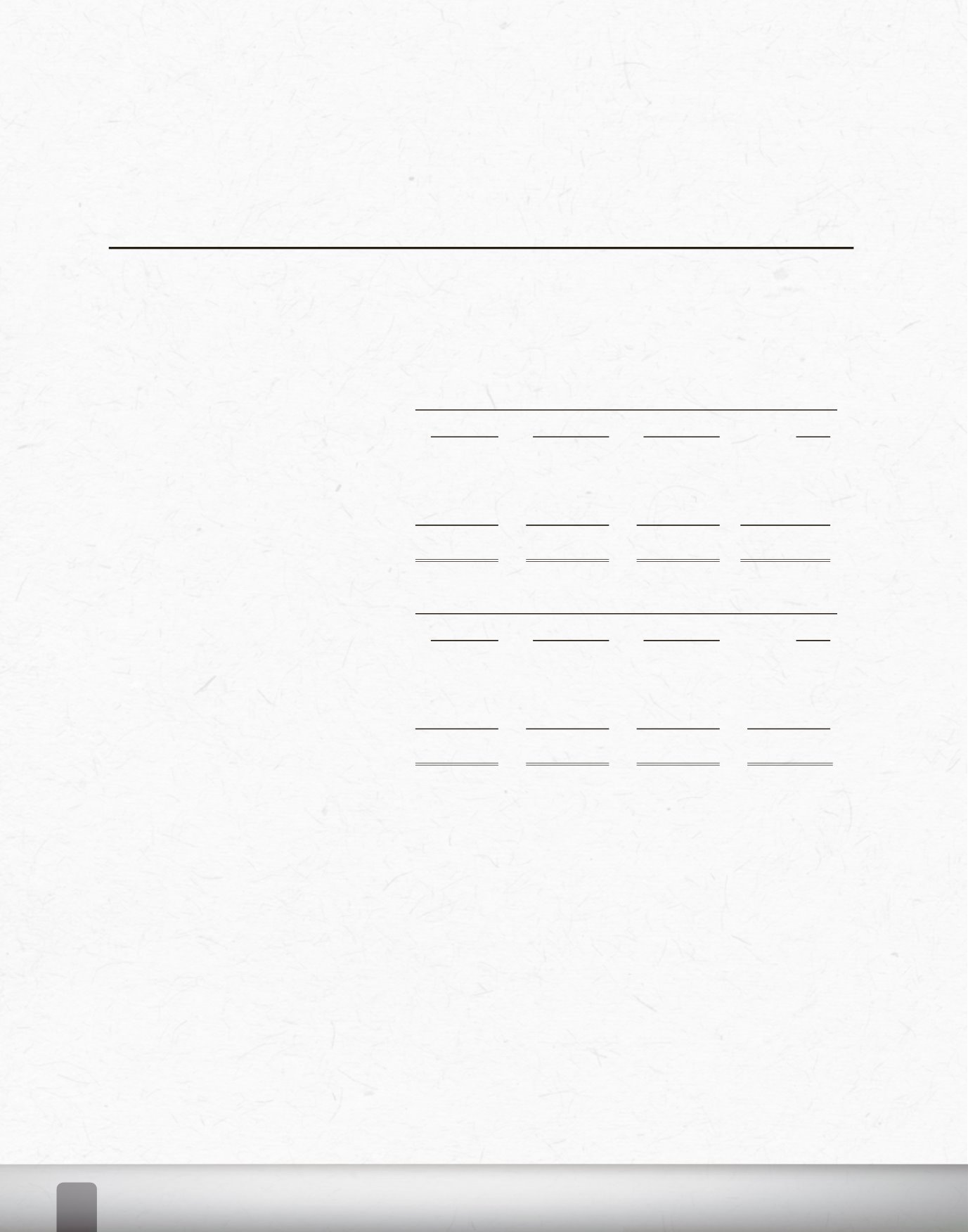

2014

1-30 days

31-60 days

61-90 days

Total

Loans and advances:

Consumer

$ 46,745,177

17,624,391

3,619,939

67,989,507

Mortgages

25,193,629

6,063,700

2,538,375

33,795,704

Business

809,638

599,402

126,189

1,535,229

Total

$ 72,748,444

24,287,493

6,284,503

103,320,440

Impairment assessment

For accounting purposes, the Credit Union uses an incurred loss model for the recognition of losses on

impaired financial assets. This means that losses can only be recognised when objective evidence of a

specific loss event has been observed. Triggering events include the following:

-

Significant financial difficulty of the customer.

-

A breach of contract such as a default of payment.

-

Where the Credit Union grants the customer a concession due to the customer experiencing

financial difficulty.

-

It becomes probable that the customer will enter bankruptcy or other financial reorganisation.

-

Observable data that suggests that there is a decrease in the estimated future cash flows from

the loans.