67

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

55

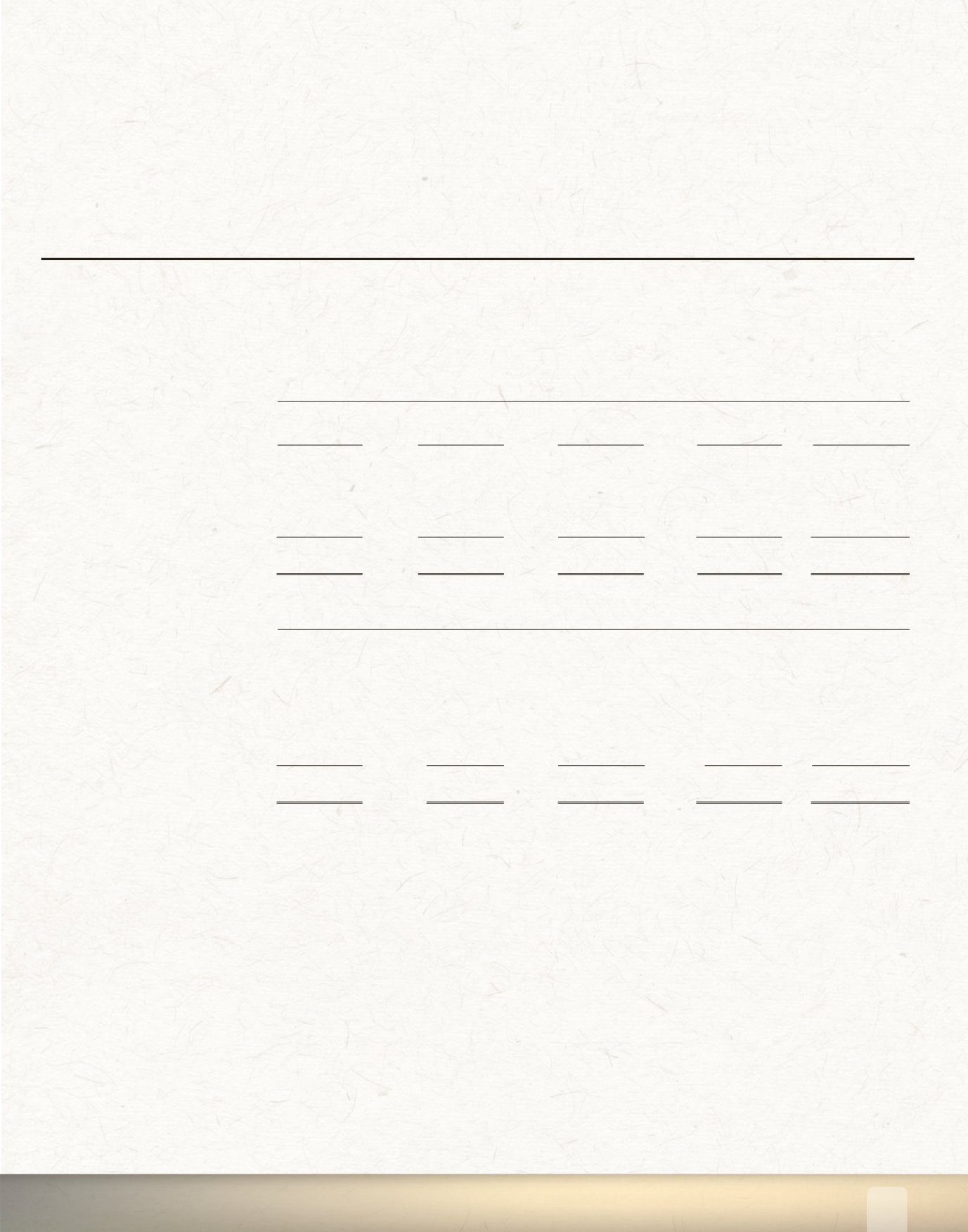

25. Financial Risk Management…(continued)

25.3 Liquidity risk and funding management...(continued)

Liquidity Risk – Financial Liabilities

2015

Within

Within

Within

Over

3 months

3 -12 months

1-5 years

5 years

Deposits

$

491,809,391

114,652,342

321,594,032

67,606,246

9

Loans payable

1,316,027

3,879,035

22,705,506

48,615,783

Reimbursable shares

-

-

6,700,221

-

Other liabilities

1,935,004

5,768,326

-

2,320,167

$ 495,060,422

124,299,703

350,999,759

118,542,196

1,0

2014

Within

Within

Within

Over

3 months

3 -12 months

1-5 years

5 years

Deposits

$

458,614,833

63,357,191

301,817,985

96,264,373

9

Loans payable

5,063,111

4,024,416

26,606,947

55,539,651

Reimbursable shares

-

-

5,351,432

-

Other liabilities

2,014,516

7,396,216

-

2,543,327

$ 465,692,460

74,777,823

333,776,364

154,347,351

1,0

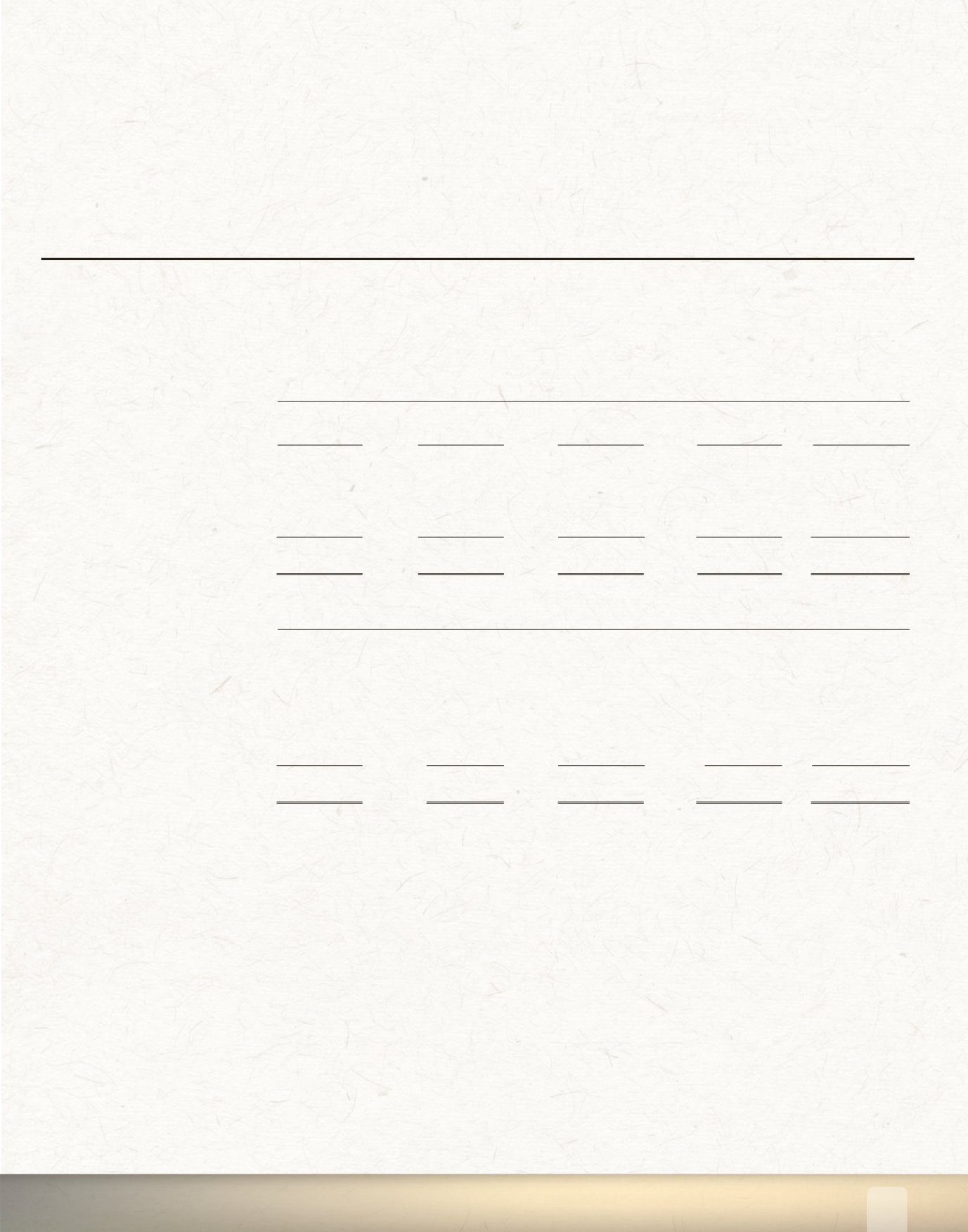

2015

Up to

Within

Within

Over

3 months

3-12 months

1-5 years

5 years Total

Deposits

$ 491,809,391

114,652,342

321,594,032

67,606,246

995,662,011

Loans payable

1,316,027

3,879,035

22,705,506

48,615,783

76,516,351

Reimbursable shares

-

-

6,700,221

-

6,700,221

Other liabilities

1,935,004

5,768,326

-

2,320,167 10,023,497

$ 495,060,422

124,299,703

350,999,759

118,542,196 1,088,902,080

2014

Within

Within

Within

Over

3 months

3 -12 months

1-5 years

5 years

Total

Deposits

$ 458,614,833

63,357,191

301,817,985

96,264,373 920,054,382

Loans payable

5,063,111

4,024,416

26,606,947

55,539,651

91,234,125

Reimbursable shares

-

-

5,351,432

-

5,351,432

Other liabilities

2,014,516

7,396,216

-

2,543,327 11,954,059

$ 465,692,460

74,777,823

333,776,364

154,347,351 1,028,593,998

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Not s to the Consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

25. Financial Risk Management…(continued)

25.4

Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to

changes in market variables such as interest rates, foreign exchange rates and equity prices. The Group

is mainly exposed to interest rate risk. The Groupʼs exposure to currency risk is minimal as a result of

the fixed rate of exchange between the Barbados and Eastern Caribbean dollar.

Interest rate risk

Interest rate risk is the risk of loss from the fluctuations in the future cash flows or fair values of financial

instruments because of a change in market interest rates. It arises when there is a mismatch between

interest-bearing assets and interest-bearing liabilities, which are subject to interest rate adjustments,

within a specified period. It can be reflected as a loss of future net interest income and/or a loss of current

market values.

BARBADOS PUBLIC WORKERS' CO-OPERATIV CREDIT UNION LIMITED

Notes to the Con lidated Financial Statements

For the year ended M rch 31, 2015

(Expressed in Barba os dollars)

25. Financial R sk M nagement…(conti ued)

25.4

Market risk

Market risk is th i

that the fair valu or future cash flows of financial instruments will fluctuate due to

changes in m rk t variables such as interest rates, foreign exchan e rates and equity pric s. The Group

is mainly exposed to inter st rate risk. The Groupʼs xp s re to currency risk is minimal as a result of

the fixed rat of xchange between th Barbados and Eastern Caribb an dollar.

Interest rate risk

Interest rate risk is th i of loss from the fluctua ions in the future cash flows or fair values of fin ncial

instruments because of a change in m rket i terest rates. It a is when th re is a mismatch between

interest-bearing ass ts and int rest-bearing lia ilities, which are subject to interest rate adjustm nts,

within a specified period. It can be reflected as a loss of future net inter st income and/or a loss of current

market values.