BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

62

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

50

25. Financial Risk Management…(continued)

25.2 Credit risk...(continued)

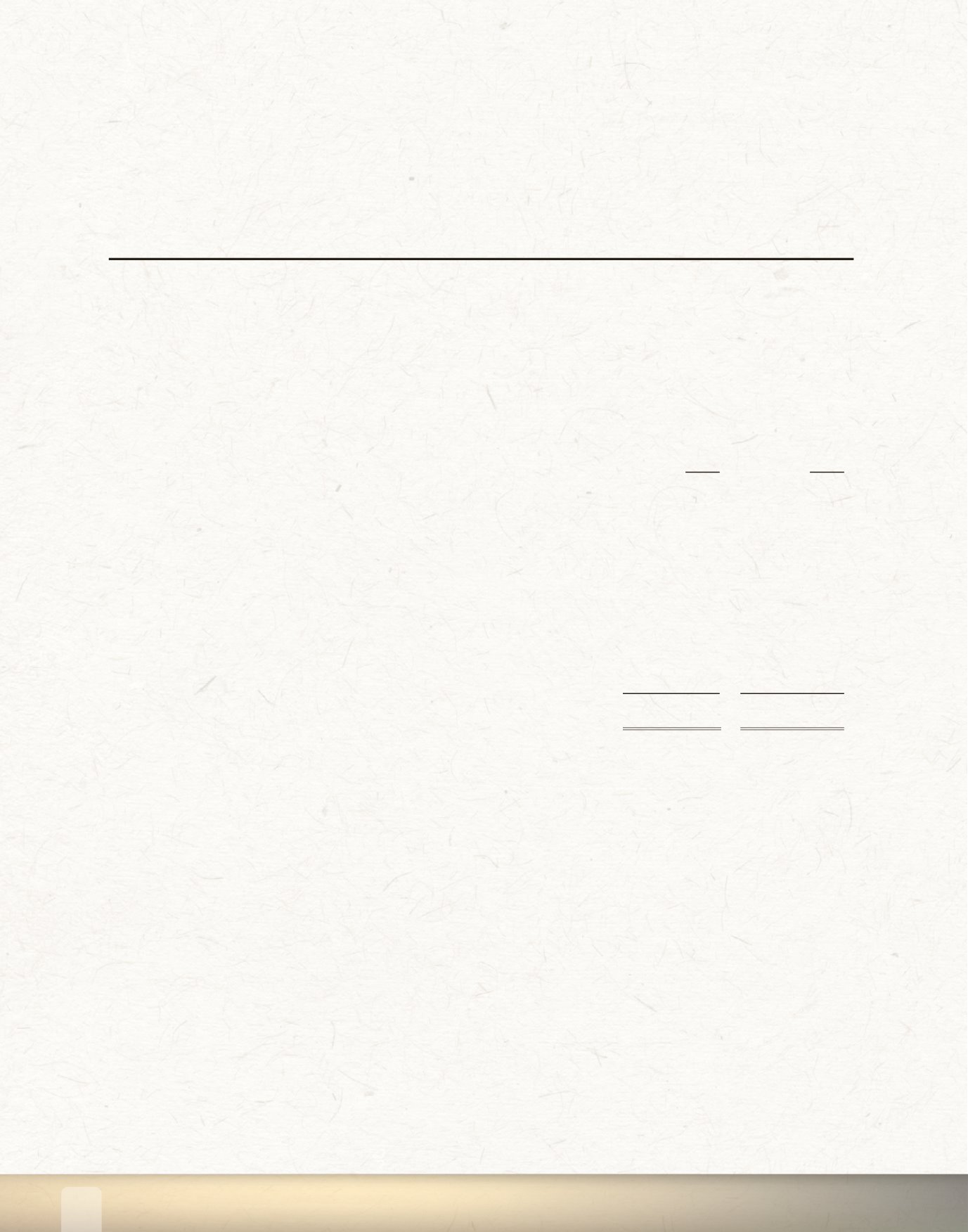

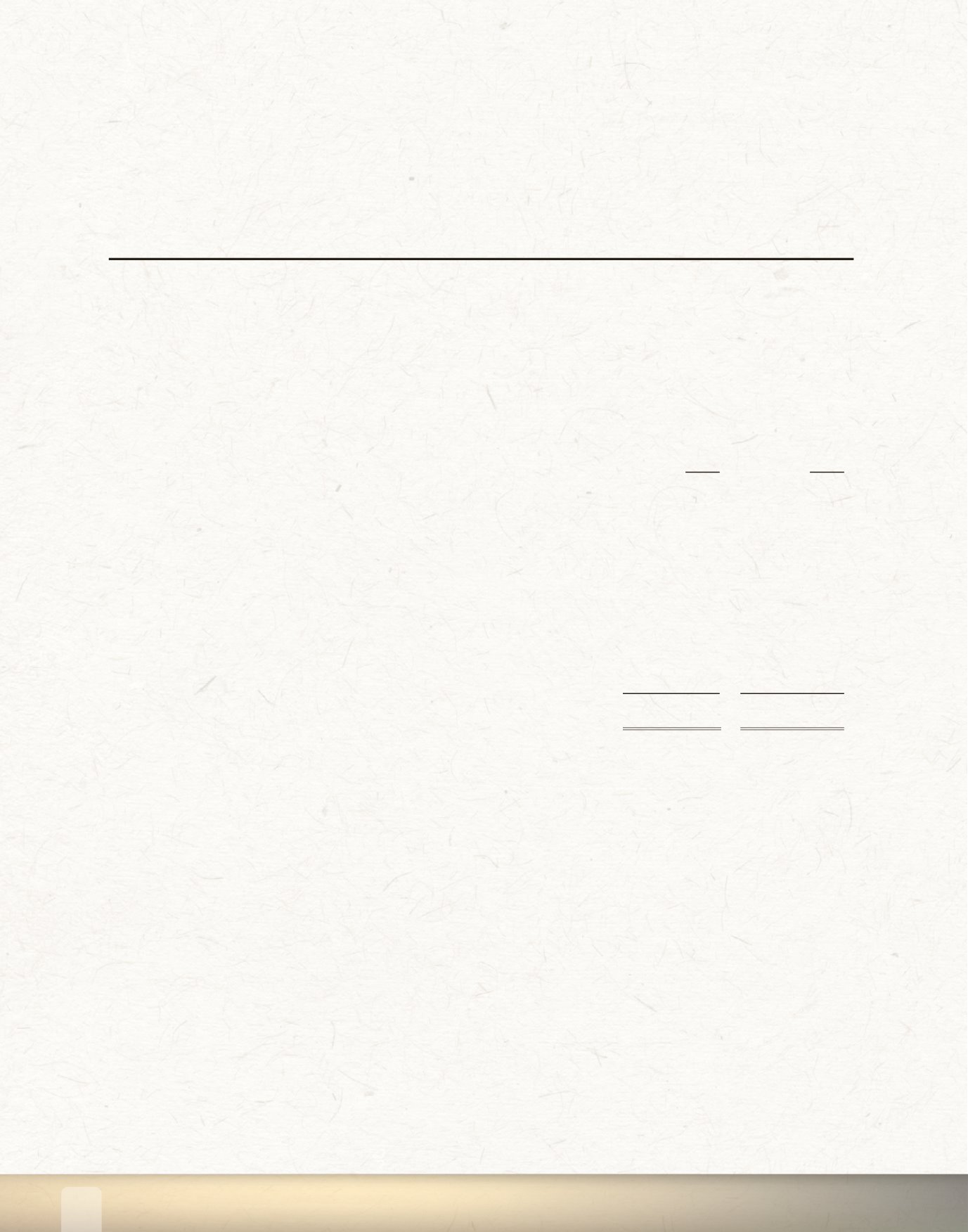

Exposure to credit risk before collateral held or other credit enhancements

Maximum exposure

Credit risk exposures relating to on-balance sheet assets are as follows:

2015

2014

Loans and advances to customers:

Consumer

$

530,921,980

482,195,181

Mortgages

360,308,001

335,513,561

Business

9,390,964

2,829,672

Financial investments:

Held to maturity

25,838,462

20,395,633

Loans and receivables

3,112,780

3,181,576

Cash resources

108,772,406

122,627,943

Credit risk exposures relating to off-balance sheet items are as follows:

Loan commitments

67,712,217

61,072,869

Total maximum exposure

$ 1,106,056,810 1,027,816,435

The above table represents the maximum credit risk exposure of the Group as of March 31, 2015 and

March 31, 2014, without taking account of any collateral held or other credit enhancements attached.

For on-balance sheet assets, the exposures set out above are based on net carrying amounts as

reported in the statement of financial position.

Credit quality by class of financial assets

Loans and advances

The credit quality of the loans and advances is managed through the prudent underwriting principles

established by the Group.

Financial investments

The Group has principally invested in government bonds issued by the Government of Barbados which

in the 2014 financial year was downgraded to a BB+ rating by Standard & Poors. During the year ended

March 31, 2015, this rating was further downgraded to BB-.

Cash and balances with Central Bank

The credit quality of financial institutions holding the Groupʼs cash resources is assessed according to

the level of their credit worthiness and by comparison to other financial institutions. The Group places

its cash resources with reputable financial institutions.