BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

40

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

27

8.

Taxation…(continued)

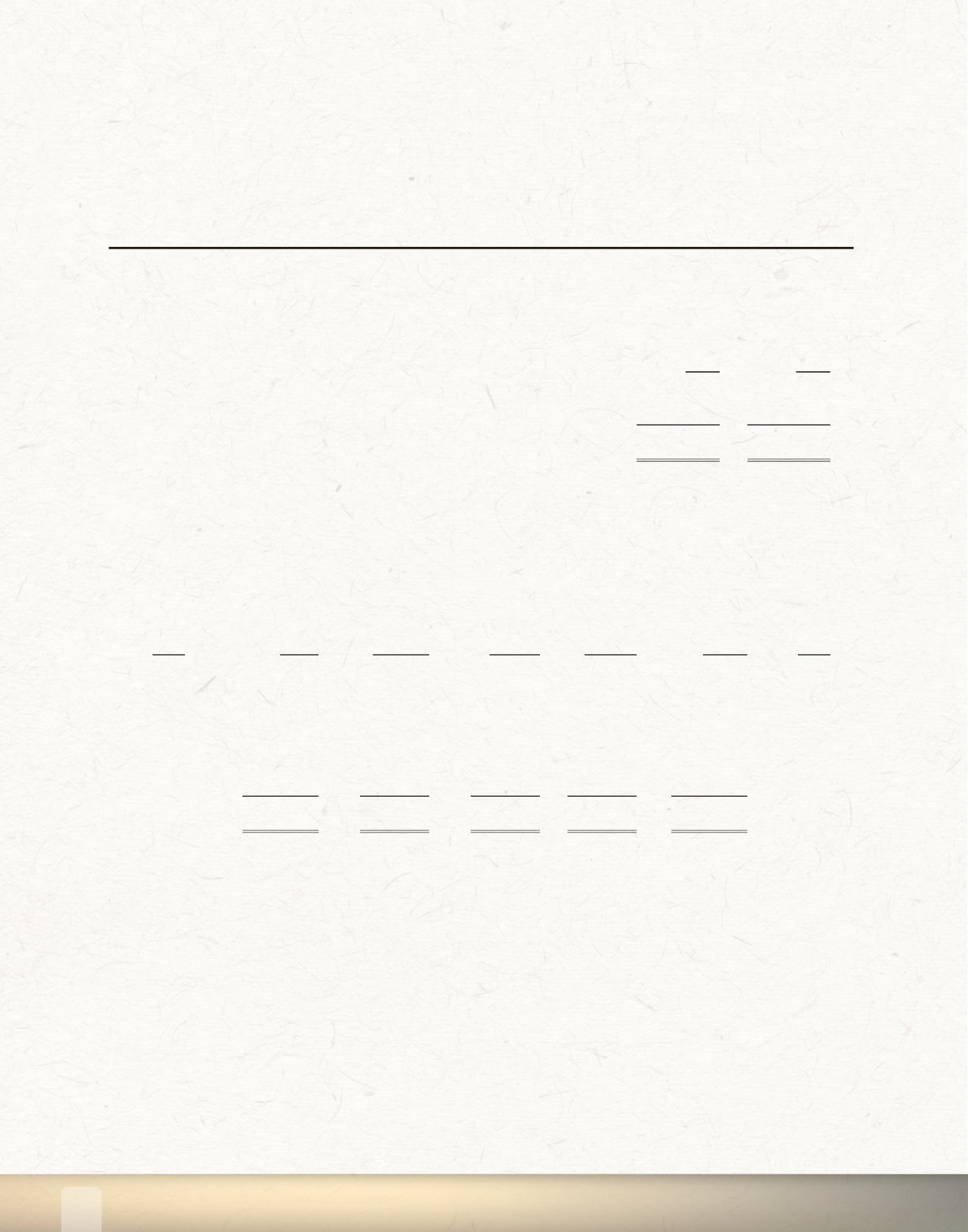

Deferred taxation

2015

2014

Beginning of the year

$

81,785

29,326

Deferred tax charge

2,256

52,459

End of year

$

84,041

81,785

The deferred tax liability consists of accelerated tax depreciation. The deferred tax asset not recognised

comprises losses and accelerated tax depreciation of the St. Lucia Branch of a subsidiary.

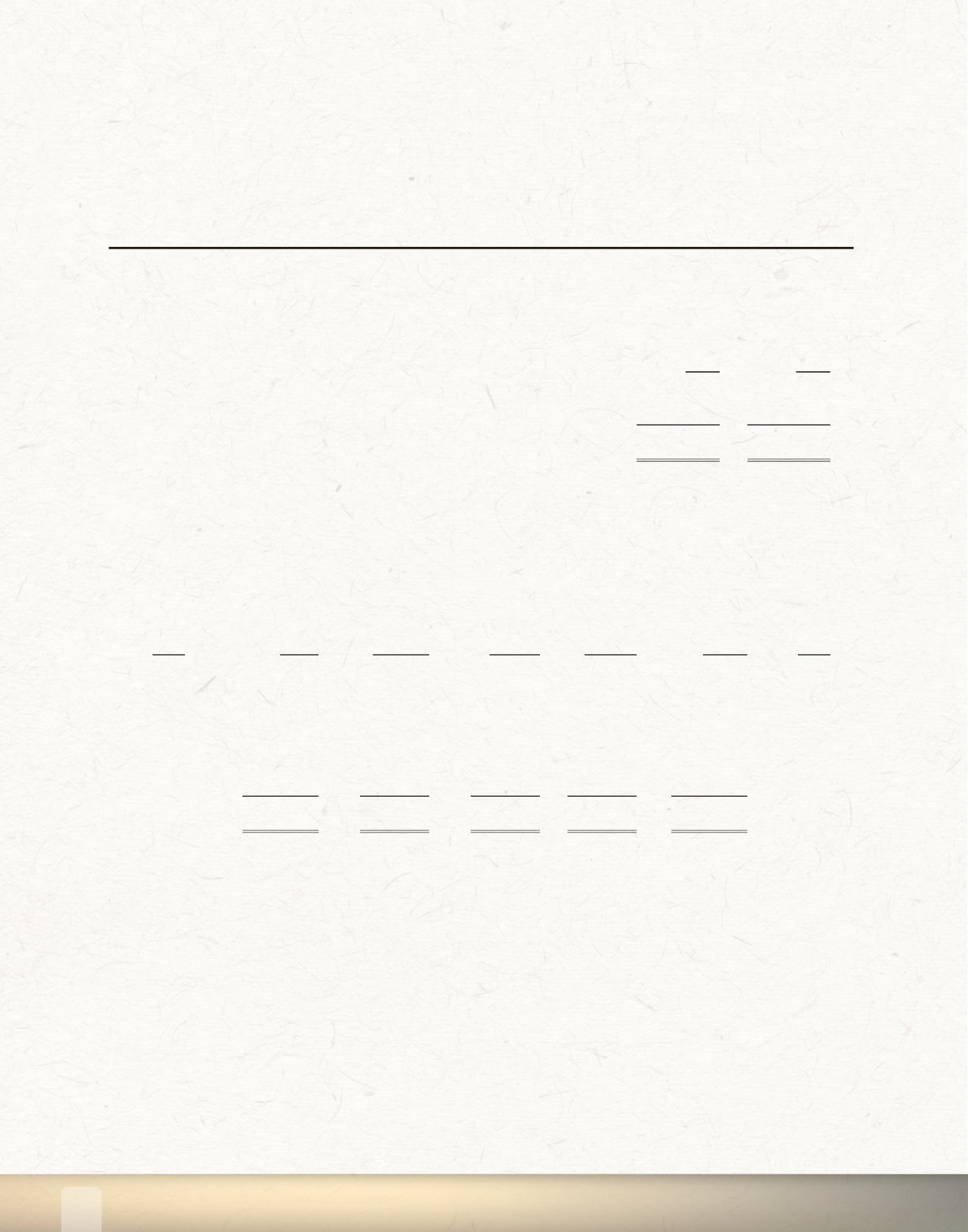

The accumulated losses for tax purposes which may be carried forward and set off against future taxable

income as follows:

Year of

Losses

Losses

Expiry

Loss

B/fwd

Incurred

Utilised

Expired

C/Fwd

Date

2009

$

97,383

-

11,721

85,662

-

2015

2010

44,017

-

-

-

44,017

2016

2011

57,777

-

-

-

57,777

2017

2012

205,852

-

-

-

205,852

2018

2013

45,474

-

-

-

45,474

2019

2014

102,616

-

-

-

102,616

2020

2015

-

-

-

-

-

$ 553,119

-

11,721

85,662

455,736

These losses are as computed by the subsidiary in its corporation tax returns and have as yet neither

been confirmed nor disputed by the Commissioner of Inland Revenue.

9.

Distributions to Members

Distributions to members include a dividend of $0.231 (2014 - $0.233) per share amounting to $393,544

(2014 - $372,400) and interest rebate amounting to $1,564,953 (2014 - $1,516,008).