39

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

CONSOLIDATED ANNUAL REPORT 2015

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Consolidated Financial Statements

For the year ended March 31, 2015

(Expressed in Barbados dollars)

26

7. Tax on Assets…(continued)

Capita Financial Services Inc., being a deposit-taking licensee, was also impacted by the Act. Effective

June 1, 2014, entities licensed under Section 22 of the Financial Institutions Act, Cap 324A with total

gross assets of which is $40 million or more and accepts deposits from third parties, shall pay by the

15

th

of the sixth (6

th

) month after each assessment quarter, a levy of 0.20% per annum on the average

domestic assets of the deposit taking licensee.

Tax on assets expense for the year amounted to $1,604,120.

8.

Taxation

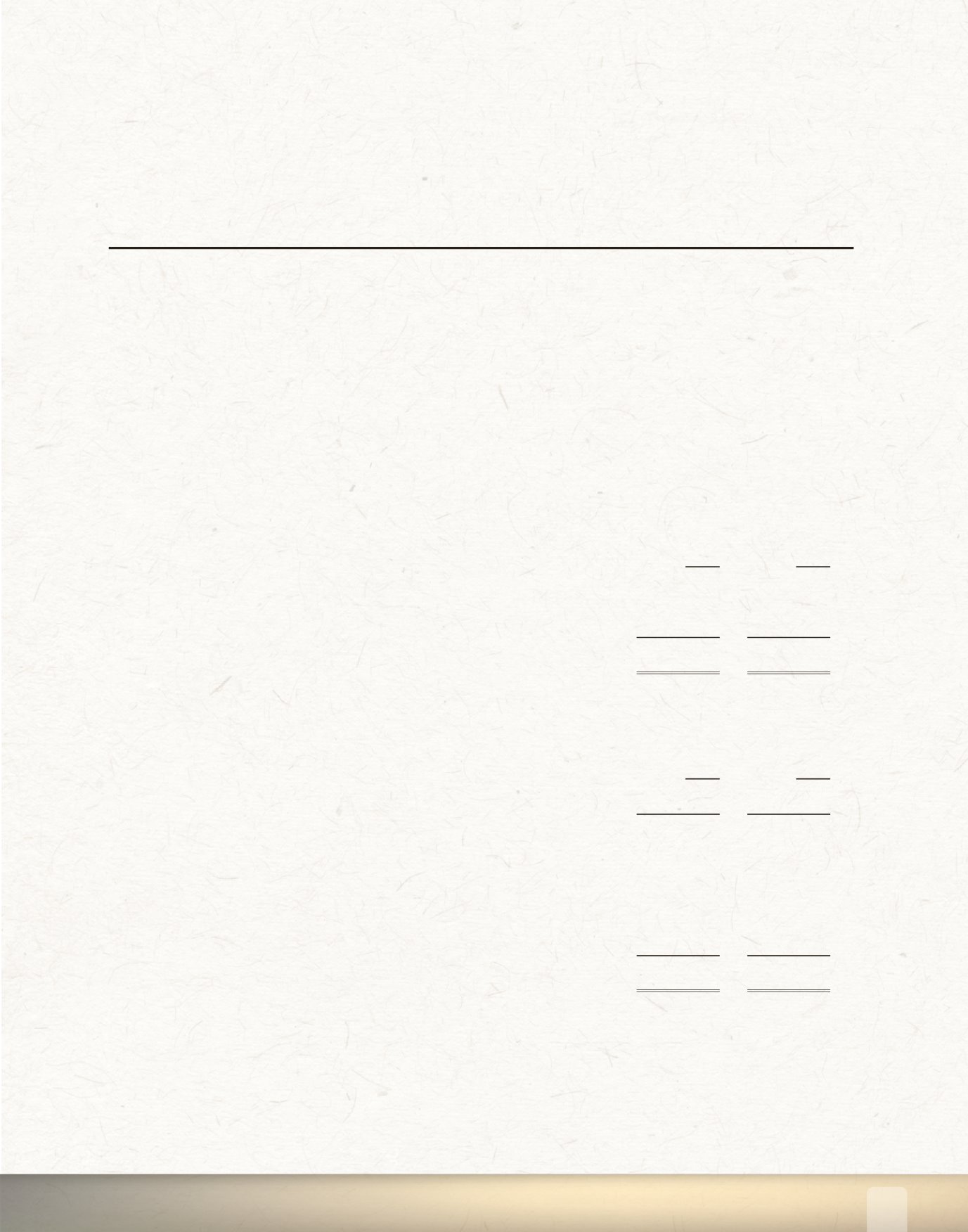

The corporation tax charge for the year is as follows:

2015

2014

Current tax expense

$

117,077

167,227

Under accrual of prior year taxes

16,396

-

Deferred tax charge

2,256

52,459

Tax expense

$

135,729

219,686

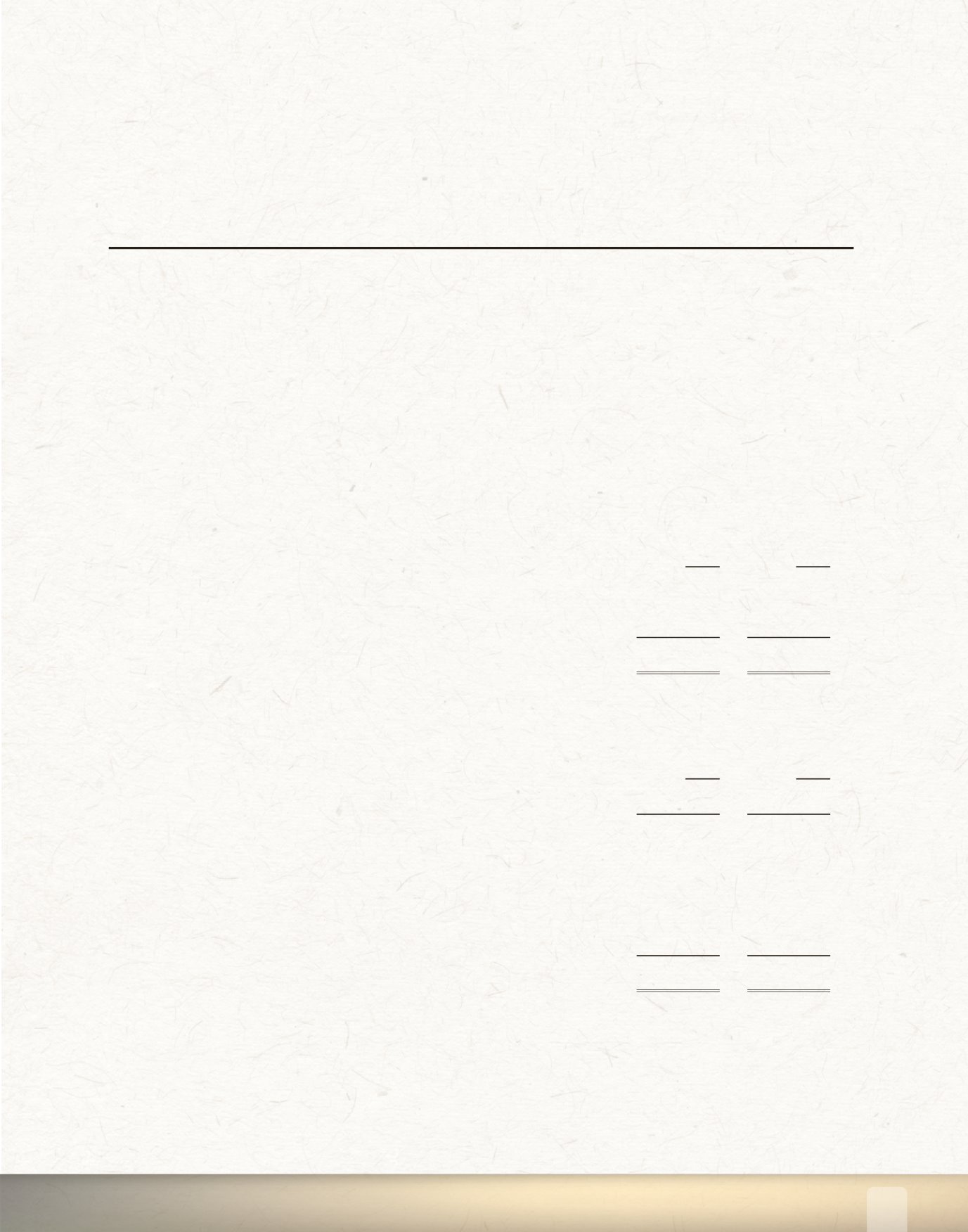

The tax on the Groupʼs income before taxation differs from the theoretical amount that would arise using

the statutory rate of corporation tax as follows:

2015

2014

Income before taxation

$ 9,777,286

11,347,099

Tax calculated at a rate of 25% (2014 - 25%)

2,444,322

2,836,775

Income not subject to tax

(2,334,089)

(2,708,984)

Effect of different tax rates

(13,221)

(8,208)

Expenses not deductible for tax

21,020

37,728

Movement on deferred tax asset not recognised

1,301

28,698

Prior yearʼs under provision of taxes

16,396

-

Other

-

33,677

Tax expense

$

135,729

219,686